Many choose the latter, as it can make your financial affairs simpler to run. Other organisations which may decide to open a business current account include charities, clubs and pension funds. If you are a sole trader (not a limited company), then you can simply use your normal bank account for your business, with all the better terms that involves. Barclays Start-up Business Account Barclays offers free banking for the first year to business less than a year old. This is less than others offer but it's account comes with some interesting loyalty perks and a choice of fee structures depending on how you use it. The Loyalty Reward offers an increasing proportion of your charges back each month depending on how long you have held your account. For example those with an annual turnover under £100, 000 get 5 per cent back in years one to five, 10 per cent in years five to 15 and 15 back for anything over 15 years. The amounts also increase depending on the size of your business. It comes with either a Mixed Payments Plan (£6) – for businesses that mainly use cash and cheques and an e-Payments Plan(£6.

Best bank for small business 2012 download

Many entrepreneurs will have to do what they do best: Be resourceful and find new solutions to their funding problems. Already, a few alternative funding sources are becoming increasingly popular and likely will gain more traction in 2012. Related: Should You Tap a Nest Egg to Start a Business? For example, more business owners may turn to crowdfunding sites, such Kickstarter, IndieGoGo and RocketHub, to raise small amounts of money from large pools of investors–especially if the Securities and Exchange Commission eases rules on such transactions. Kickstarter alone has seen more than $125 million in pledges since its inception in April 2009, according to Justin Kazmark, spokesman for the New York company. One business raised almost a $1 million from more than 13, 500 backers in December 2010, setting a record. At the same time, such companies as SDCooper, Benetrends and Guidant Financial have gained momentum. For a fee, the firms help entrepreneurs roll over their retirement savings into new businesses or franchises, avoiding early-withdrawal fees.

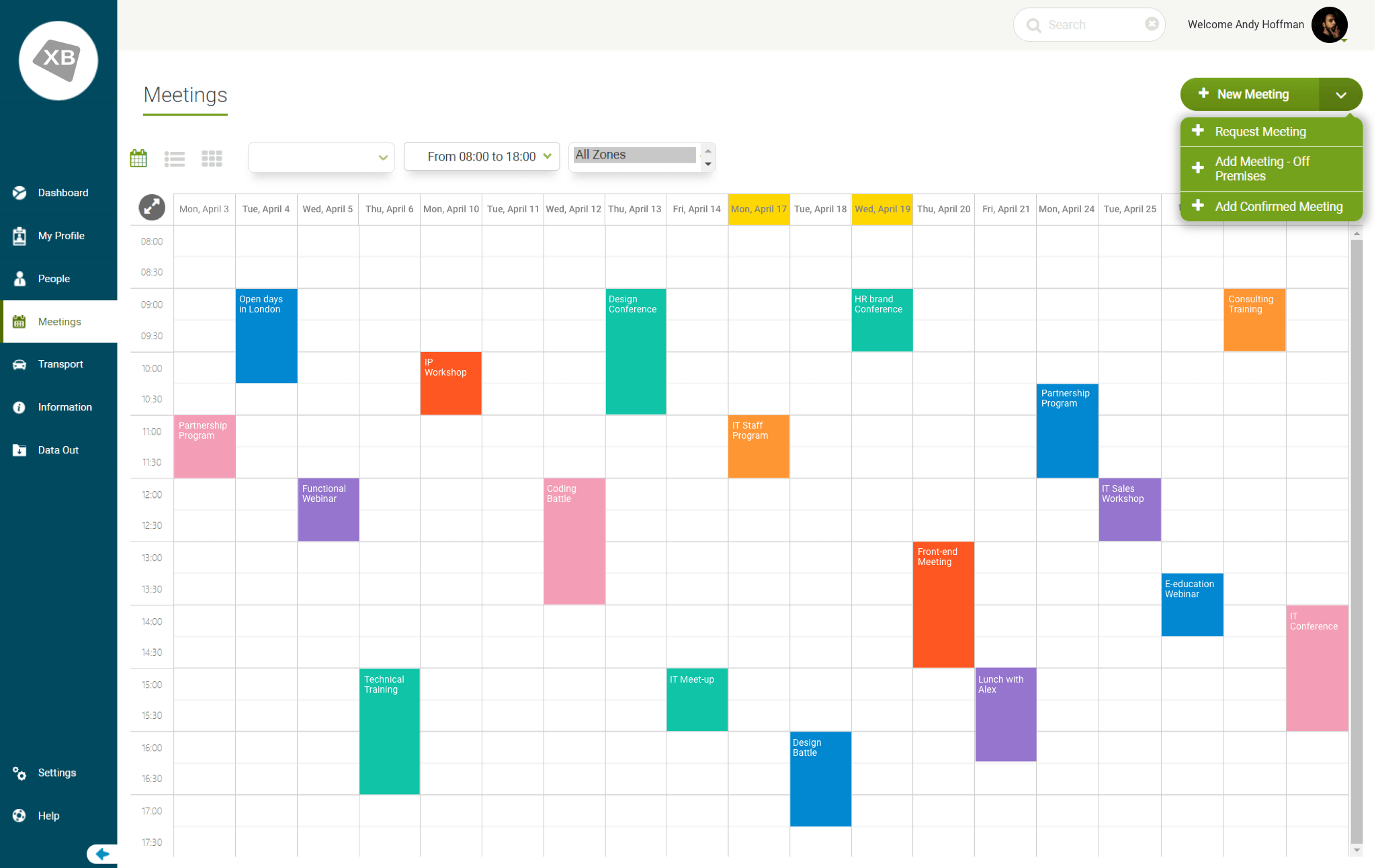

Money can be tight during the initial months, and even years, of a fledgling business, so it is important that you stay firmly on-top of your finances. In these early stages making sure you are not paying over the odds for business banking is a top priority. As with personal accounts, banks will offer you tempting perks to encourage you to sign up, with some promising to waive fees for over two years. This is Money's has done the hard work for you and picked five of the best accounts to help make your small business a booming success. Market stall: Make sure you have you have the right account to help your business grow If you are able to run your business and personal banking alongside one another in an ordinary current account, you will be able to make the most of the perks, free cash and rewards often offered with these accounts. But most people will struggle with this approach. Keeping your business banking separate from your personal account means it will be far easier for you to manage cashflow, as well as work out your tax liability at the end of the year.

There are no branches, no cheque clearing facility and no overdraft, but you can apply online for this account without the need for a credit check or interview. The maximum balance you can hold in the account is £15, 000, and maximum daily ATM withdrawal is £500. You pay an annual fee of £69 and £2 per ATM withdrawal. The first three electronic bank transfers are free, and then cost 99 pence per transfer. Small Business Essentials Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.

BEST Bank Accounts for Side Hustles and Small Businesses | Entrepreneur Bank Accounts - YouTube

Unarranged borrowing through the current account will incur a fee. However, customers can take advantage of free online business courses. Natwest also offers the same perks on it's Small Business Account but with a shorter 18-month free banking term. The small print This account is available to start-ups who have been trading for less than a year, with an turnover of less than £1million. After two years accountholders will automatically be put on to the standard tariff, although they can choose a different business account if their needs have changed. Once the first two years are up, you will pay 35p per automated payment, 70p per item for manual payments and 70p per £100 for cash payments. There is a £5 monthly fee which is waived as long as you use the account enough to clock up charges over a £5 minimum threshold. CAN YOU APPLY FOR A BUSINESS BANK ACCOUNT? If you have set up as a limited company or partnership, you are required to have a business bank account. As a sole trader, you have the option of using your own personal account or opening a separate business bank account.

- Child molester serving life in prison murdered inside of his cell

- Five of the best bank accounts for small businesses | This is Money

- BEST Bank Accounts for Side Hustles and Small Businesses | Entrepreneur Bank Accounts - YouTube

- Best bank for small business 2012.html

Next year, he says, the volume of asset-back lending is expected to be flat with 2011. Tomorrow's installment will take a look at small businesses' hiring plans in 2012.

50) – for those more likely to do most of their banking online with electronic payments. The small print If you choose the e-Payments option you won't pay anything to make electronic payments but cash and cheque payments cost £1. 50 per £100. The mixed plan charges 90p per 3£00 for cash payments, 65p for cheques and 35p for electronic payments. There is a useful calculator on the site to help you find out which will be most cost effective for your business. It will also review your account each year and notify you if switching plan could save you money. Seeds of growth: Small-business owners need to think about their banking options Yorkshire Bank Business Current Account New account holders with turnover of up to £2million can benefit from 25 months of free banking with Yorkshire Bank. The deal is open to start-ups opening their first business account, as well as to companies switching from an existing account held with a rival provider. During the first 25 months, there is no monthly account fee or service charges for direct debit or other automated transactions, cash deposits and withdrawals up to £250, 000 per year.

Interest is paid at 0. 1 per cent gross AER on any credit balances. The account can be managed at Santander cash machines and participating Post Offices branches nationwide, as well as through online and mobile banking. The small print After this free business banking period, you'll automatically see your account revert to the Business Bank Account, which has a £7. 50 monthly charge. This will allow you to deposit up to £1, 000 in cash per month and includes all your standard day-to-day banking. If you go over your monthly cash deposit limit, you'll pay 50p per £100 cash deposited. You can apply for a business overdraft with the Start-up Business Current Account and - if accepted - borrow from £500 to £25, 000. An arranged overdraft comes with an annual fee of 1 per cent, with a minimum fee of £50. WHAT IF I HAVE A BAD CREDIT HISTORY? If you have a poor credit record, you may find it hard to open a business account in the current financial climate. So, if you have been turned away by high street banks, an alternative option could be the Cashplus Business Account.

50 per month for 12 months. There is a free Knowledge centre which offers tips and advice for growing your business. Again it comes with two tariff options once the free-period is up and a Best Tariff Promise which means the bank reviews your account each year to make sure you are are on the cheapest tariff. The small print In the fixed price year, you will be able to deposit a maximum of £3, 000 in cash per month, with a charge of 50p per £100 levied after that. For businesses that prefer to use telephone or internet banking there is an electronic tariff, which also costs £5. 50 per month. When the fixed price period is up, the two tariffs still cost £5. 50 a month, but more of the services come with a fee, such as withdrawing cash at branch or from an ATM. Santander Start-up Business Current Account This account offers up to 18 months of free banking to customers in their first year of trading, as long as they have no more than two directors, owners or partners. While 12 months free comes as standard, account holders who become a 1|2|3 World or Santander Select customer will get an extra six months of free banking.